Toronto, Ontario, June 18th, 2020 – Grid Metals Corp. (the "Company") (TSXV:GRDM) is pleased to announce that a diamond drilling program is underway at its 100% owned East Bull Lake ("EBL") palladium property ("the Property") in Ontario. Grid is targeting palladium dominant mineralization. The Property is located approximately 80 km west of Sudbury, Ontario.

Program Details

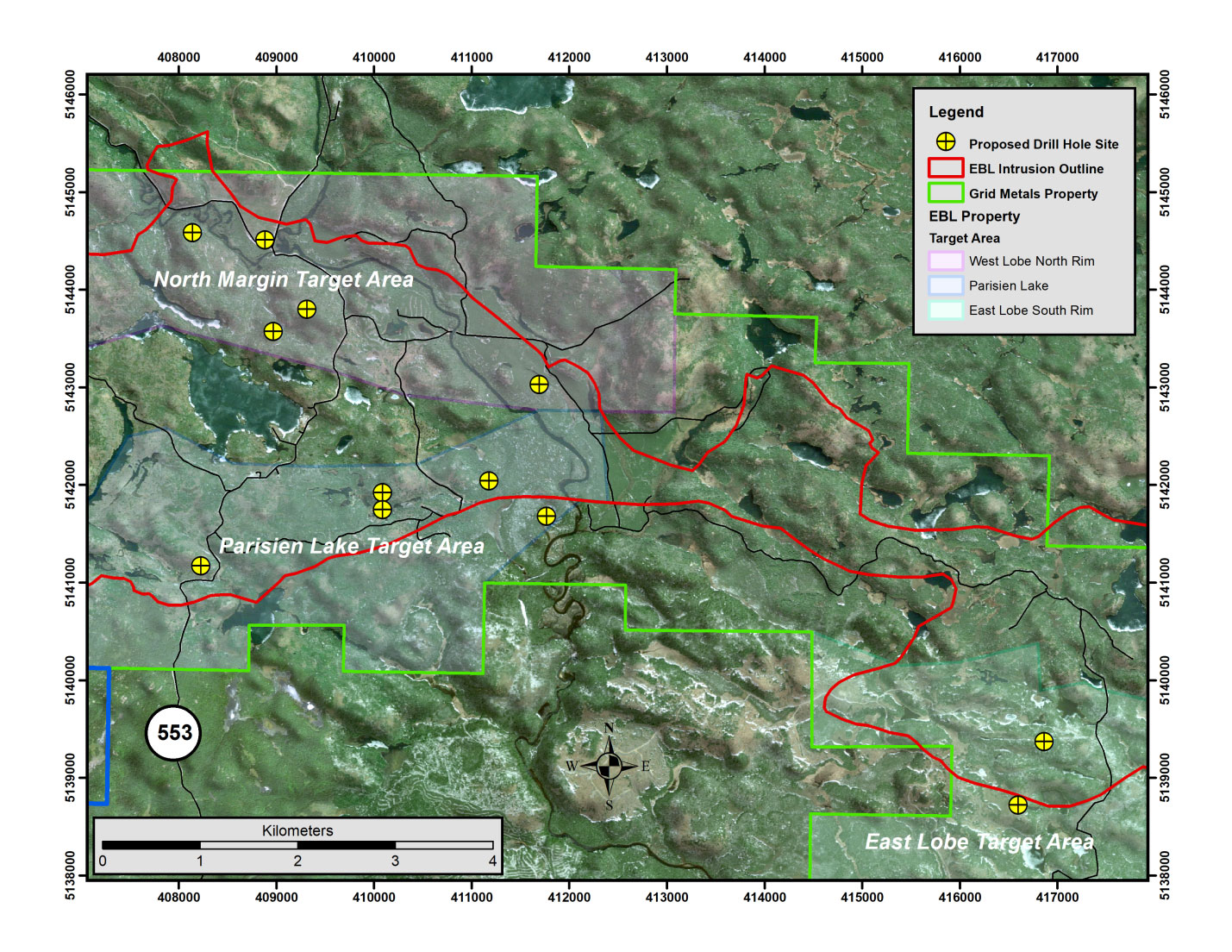

- Approximately 5,000 metres are planned in 9 diamond drill holes covering three large target areas in the highly prospective EBL intrusion

- Stage 1 will include 5 holes and approximately 2,650 metres in the Parisien Lake area, testing several geophysical anomalies over a depth range of 200 to 500 metres

- Stage 2 will include 2 holes in the southern margin of the East Lobe of the intrusion and 2 holes in northern margin of the West Lobe, testing geophysical anomalies over a depth range of < 100 to 300 metres

Note that the current program plans are subject to change based on results obtained and other factors.

Dr. Dave Peck, P.Geo., the Company's VP Exploration and Business Development commented "we will be testing several MT anomalies in the current drilling campaign. The program is intended to validate our exploration model, which predicts that multiple trap sites for palladium-rich magmatic sulfides were developed within or adjacent to primary feeder structures in the EBL intrusion. Success for this program is defined as validation of the MT survey method as an effective tool for detecting thicker, higher-grade and more continuous areas of palladium-rich magmatic sulfide mineralization than what have thus far been discovered on the property."

Program Objectives and Technical Rationale

The Company previously announced results from a recently completed magnetotelluric ("MT") geophysical survey that covered several prospective target areas within the EBL property (see the Company's April 28, 2020 and May 23, 2020 news releases). The MT survey results were subsequently analyzed using 2D and 3D modeling tools, leading to the delineation and ranking of numerous, discrete anomalies featuring reduced electrical resistance (resistivity). None of the MT anomalies selected for drilling have been tested by previous drill holes. Some of the larger anomalies display undulating forms that could reflect the development of structural embayments along the basal contact of the intrusion. When ranking the anomalies, the Company's technical team considered several factors including: geology; proximity to known near-surface palladium mineralization; association with potential feeder structures; vertical and lateral extent and general form of the anomalies; and, depth and intensity of the anomalies.

The first anomalies to be tested occur in the Parisien Lake target area where the nearly 3,000 historical surface and drill core samples collectively demonstrate a positive correlation between magmatic sulfide content and palladium grade. The existing assays for this area include palladium grades of up to 9.56 g/t Pd (drill hole EB08-02, 89.9 to 91.0m) with 9% of all samples having anomalous Pd grades of > 0.5 g/t and 4% of all samples having Pd grades of > 1.0 g/t. The known palladium mineralization occurs within the upper ~200m from surface and is associated with the stratigraphically lowermost gabbroic rock units of the EBL intrusion. However, the known, near surface palladium mineralization was not detected by the MT survey. This finding underpins the current working model that predicts the newly defined MT anomalies at Parisien Lake represent areas of enhanced sulfide content and palladium grade.

If the results from Parisien Lake are positive, the Company will continue the drilling program with two holes planned for the southern margin target area in the East Lobe of the intrusion and two holes proposed for the northern margin of the West Lobe of the intrusion. The Company expects to report on initial results from the Parisien Lake drilling next month.

Dr. Dave Peck, P.Geo., has reviewed and approved the technical content of this release for purposes of National Instrument 43-101.

Grant of 225,000 Incentive Options

The Company also announced that it has granted a total of 225,000 incentive stock options to two officers of the Company and one consultant. The stock options are exercisable at a price of $0.25 per share for a period of five years from the date of grant. The incentive stock options were granted in accordance with the Company's Stock Option Plan and are subject to regulatory approval.

About Grid Metals Corp.

Grid Metals Corp. is an exploration and development Company that has a diversified portfolio of projects in the nickel-copper-platinum group metal sectors. These commodities are vital to the emerging battery metals, energy storage and automotive sectors. All of Grid's projects are located in secure North American mining jurisdictions. The Company is focused on timely advancement of its property portfolio through prudent exploration and development activities.

To find out more about Grid Metals Corp., please visit www.gridmetalscorp.com.

On Behalf of the Board of Grid Metals Corp.

Robin Dunbar - President, CEO & Director Telephone: 416-955-4773

Email: rd@gridmetalscorp.com

David Black - Investor Relations Email: info@gridmetalscorp.com

We seek safe harbour.

This news release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of the Securities Act (Ontario) (together, "forward-looking statements"). Such forward-looking statements may include the Company's plans for its properties, the overall economic potential of its properties, the availability of adequate financing and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements expressed or implied by such forward-looking statements to be materially different. Such factors include, among others, risks and uncertainties relating to potential political risk, uncertainty of production and capital costs estimates and the potential for unexpected costs and expenses, physical risks inherent in mining operations, metallurgical risk, currency fluctuations, fluctuations in the price of nickel, cobalt, copper and other metals, completion of economic evaluations, changes in project parameters as plans continue to be refined, the inability or failure to obtain adequate financing on a timely basis, and other risks and uncertainties, including those described in the Company's Management Discussion and Analysis for the most recent financial period and Material Change Reports filed with the Canadian Securities Administrators and available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

This news release does not constitute an offer of securities for sale in the United States. The securities being offered have not been, nor will they be, registered under the United States Securities Act of 1933, as amended, and such securities may not be offered or sold within the United States absent U.S. registration or an applicable exemption from U.S. registration requirements.

Figure 1. Location of proposed drill hole collars for the 2020 diamond drilling program at EBL.