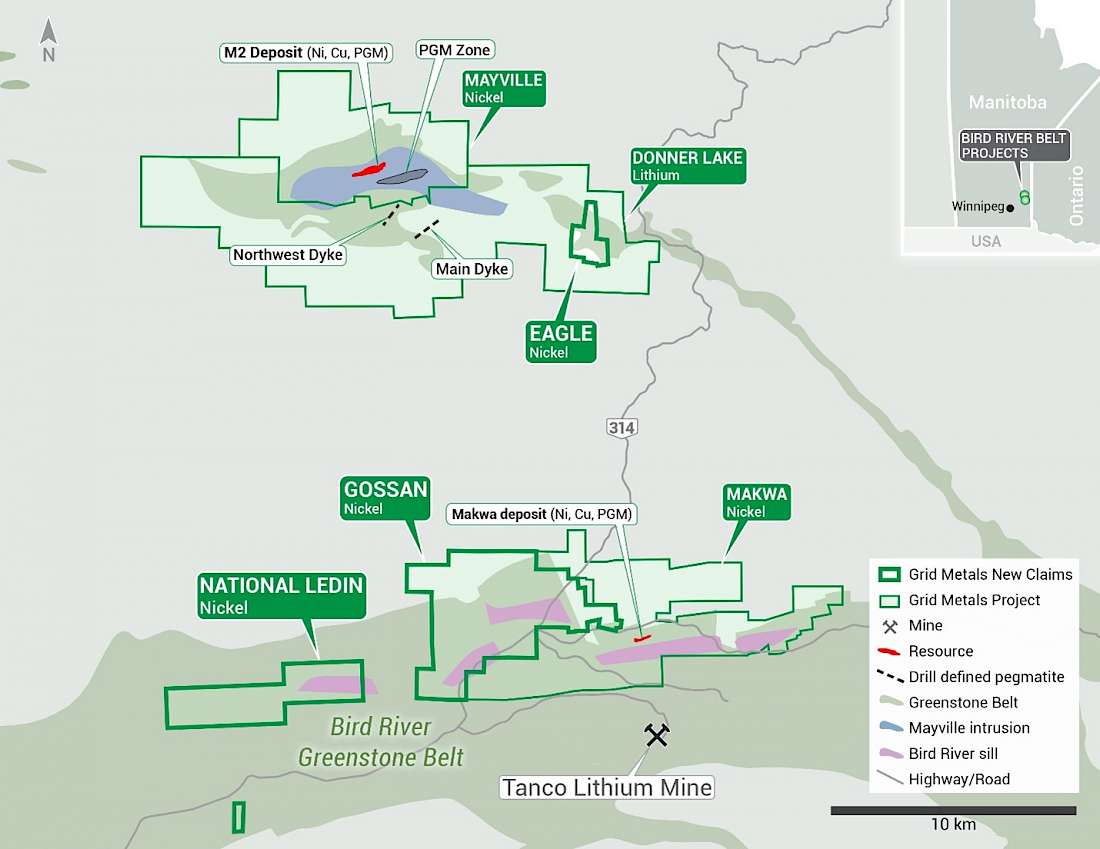

April 13, 2023. Grid Metals Corp. (TSXV:GRDM; OTCQB:MSMGF) (the "Company") is pleased to announce that it has entered into agreements with arms’ length third party vendors to acquire additional property in southeast Manitoba. The acquisitions have enabled Grid to establish a dominant land position prospective for nickel, copper, platinum group metals and cobalt – all key critical metals. Additional ground in the belt has been acquired through staking. The new properties provide a significantly enhanced scope for the discovery of additional nickel-copper-PGM mineralization in the belt.

The transactions are as follows:

- Acquisition from Gossan Resources Limited of the Ore Fault, Page and Chrome nickel-copper sulfide resources and associated exploration properties that adjoin the Company’s Makwa nickel property to the west:

- Indicated and Inferred resources of Ni-Cu-PGM-Au mineralization prepared in accordance with NI 43-101 in two discrete near-surface deposits (Technical Report and Resource Estimate on the Ore Fault, Galaxy and Page Zones of the Marathon/Gossan Resources Bird River Property, Southeast Manitoba (P&E Mining Consultants Inc., Feb. 26, 2009))

- Page 1.5Mt at 0.32% Ni and 0.13% Cu Indicated

- Ore Fault 0.9Mt at 0.32% Ni and 0.24% Cu Indicated

- Ore Fault 2.5Mt 0.35% Ni and 0.19% Cu Inferred

- 51 mineral claims encompassing approximately 2,870 hectares

- Claim block viewed as prospective for additional nickel + palladium mineralization

- Acquisition from a subsidiary of First Mining Gold Corp. of the Eagle Claims which host the historical New Manitoba nickel-copper sulfide deposit, located 9 km east of the Company’s Mayville M2 resource:

- New Manitoba deposit has a historical mineral resource estimate of 1.8Mt at 0.75% Cu and 0.33% Ni (Manitoba Mineral Inventory Card #217) ( Note: the Company has not been able to verify the historical estimate as relevant and the historical estimate should not be relied on)

- 10 claims and 238 hectares

- Claim block viewed as prospective for Mayville M2 type Ni-Cu-PGM mineralization

- Eagle Claims also capture prospective ground for lithium-bearing pegmatites and are enclosed by the Company’s Donner Lake property

- Staking of additional mining claims in the Bird River Belt including:

- The National Ledin property (5 claims, 1,280 hectares) covering the western extension of the Bird River Sill directly west of the Gossan Resources claims

- Property relatively unexplored but considered prospective for Makwa-type Ni-Cu-PGM mineralization

Above: Map of Bird River area showing National Ledin, Gossan and Eagle claim blocks acquired by Grid.

Nickel Copper Project Status and Strategic Goals

The Company currently owns a resource prepared in accordance with NI 43-101 comprising a total of 33.3 Mt of Indicated Resources averaging 0.27% Ni, 0.37% Cu and 0.14 g/t Pd (Report on the Preliminary Economic Assessment of the Combined Mayville-Makwa Project, Manitoba, Canada (RPA, Inc., April 2014)). The resources comprise two separate near-surface magmatic sulfide deposits, viz.:

- The Makwa deposit, comprising 7.2 Mt of Indicated Resources averaging 0.61% Ni, 0.13% Cu and 0.36 g/t Pd; and,

- The M2 deposit, comprising 26.6 Mt of Indicated Resources averaging 0.18% Ni, 0.44% Cu and 0.14 g/t Pd

Note: A new NI 43-101 resource estimate for Makwa and M2 is in the process of being prepared by Micon International to incorporate drilling and metallurgical work completed by the Company since 2014.

The acquisition of these new properties will result in an immediate increase to project resource inventory and provide significant scope for further resource expansion through exploration. The Company’s aspirational target/model (goal) is to expand the base metal resources at the project to greater than 200,000 tonnes of contained nickel and 300,000 tonnes of contained copper (i.e., increase global resources to >80 million tonnes combined at approximate current grades) and to proportionally increase the associated platinum group metals and cobalt content. The Company believes that these levels will provide scope for a long-life high output nickel copper PGM operation having high metal tenors and average grades similar to that of the Kevitsa Mine (Boliden NL) in northern Finland – one of the lowest cost nickel producers in the world.

Details of the Transactions

Gossan Resources Transaction - The Company has executed a purchase agreement with Gossan Resources Limited for a 100% interest in the Chrome, Page and Ore Fault claims (collectively, the “Gossan Claims”). The purchase price for the Gossan Claims is $1.1 million in cash over three years (with $500,000 payable in year 1) and 1,500,000 common shares in the capital of the Company (“Common Shares”). The Common Shares will be subject to an initial statutory hold period of four months and one day from closing of the transaction. Thereafter, the Common Shares will be released from escrow in monthly tranches of 75,000 shares over twenty months. The Company has granted Gossan Resources a 2% net smelter return (“NSR”) royalty payable upon the commencement of commercial production from the property. In addition, a $300,000 deferred cash payment is due to Gossan Resources upon the commencement of commercial production from the property.

First Mining Gold Transaction - The Company has also executed a purchase agreement with a subsidiary of First Mining Gold Corp. for a 100% interest in the Eagle Claims. The purchase price for the Eagle Claims is $300,000 cash on closing and 250,000 Common Shares subject to a statutory hold period of four months and one day from closing of the transaction. The Company has granted First Mining Gold a 2% NSR royalty payable upon the commencement of commercial production from the property, half of which can be bought back by the Company for by paying $1 million cash to First Mining Gold. In addition, a deferred cash payment is due to First Mining Gold if the Company defines a greater than 2 million tonne NI 43-101 mineral resource on the property.

Robin Dunbar, President and CEO of Grid Metals stated " The transactions announced today have consolidated our land position in the Bird River area, add resource inventory and give us additional wide scope for new discoveries of nickel, copper and platinum group metals. We have been eyeing these assets for several years and are pleased to now have been in a position to transact. With future demand for nickel and copper expected to be very strong the time was right for us to move forward and acquire these assets to solidify our base metal position in the Bird River area.”

The Company expects to close the transactions with Gossan Resources and First Mining Gold on or before April 21, 2023.

About the Gossan Claims

The Gossan Claims encompass two major structural blocks (Page and Chrome blocks) within the southern limb of the Bird River Greenstone Belt. Both blocks include 3 to 4 km-long segments of the Bird River Sill, host to the Company’s Makwa nickel sulfide deposit, which occurs on adjacent tenements located directly to the south and east. Together with the recently staked National Ledin property to the west of the Gossan Claims (see further details below), the Company now effectively controls the full extent of the Bird River Sill covering ~25 km of strike length.

The Gossan Claims have seen intermittent nickel sulfide, PGM, chromite, gold and Cu-Zn exploration over many decades. They cover three main exploration properties including the Chrome, Page and Ore Fault claims. Much of the historical exploration work was focused on chromite and PGM and led to the discovery of multiple occurrences of both target commodities. The Chrome property hosts what was previously (1940s) Canada’s only chromite mineral resource.

More recently, Gossan Resources, through a joint venture agreement with a third party explorer, drilled off two near surface resources - the Page Zone and the Ore Fault Zone deposits. Mineral resource estimates for the two deposits (P&E Mining Consultants Inc., 2009 – see previous reference ) prepared in accordance with NI 43-101 are as follows:

Page Zone: 1.50 Mt of Indicated Resources averaging 0.32% Ni, 0.13% Cu and 0.28 g/t Pd and an additional 0.26 Mt of Inferred Resources averaging 0.27% Ni, 0.09% Cu and 0.25 g/t Pd

Ore Fault Zone: 0.91 Mt of Indicated Resources averaging 0.37% Ni, 0.24% Cu and 0.37 g/t Pd and an additional 2.51 Mt of Inferred Resources averaging 0.35% Ni, 0.19% Cu and 0.40 g/t Pd

Both deposits exhibit similar geological and grade characteristics to the Company’s Makwa nickel sulfide deposit and are seen as being direct analogues of the latter. The Company believes that there is significant potential for expanding on the current mineral resources for the Makwa deposit and for discovering additional nickel sulfide resources on the Gossan Claims and on the adjacent Makwa property.

About the Eagle Claims

The Eagle Claims are underlain by mafic intrusive rocks hosted by the Bird River greenstone belt. The intrusive rocks host a historical nickel-copper sulfide mineral resource known as the New Manitoba deposit. A historical mineral resource estimate for the New Manitoba deposit outlined 1.8 million tonnes grading 0.75% Cu and 0.33% Ni (MB Mineral Inventory File #217). The Company is unable to verify the accuracy of this historical mineral resource estimate but based on the historical assessment filings believes there is potential for a resource of this magnitude to be defined by exploration drilling. The deposit was discovered in 1943 and was on a path to production in 1957 when a former owner of the Eagle Claims, New Manitoba Mining and Smelting, sunk a 192-metre-deep shaft and began construction of an on-site concentrator. However, these initial mining efforts were curtailed due to a period of low nickel prices and since that time the property has seen only sporadic exploration activity. Historical drilling results for the New Manitoba deposit are similar to those obtained for the Company’s M2 deposit located ~9 km to the west. In both deposits, average copper grades are generally double the nickel grades and sulfide mineralization typically occurs over true widths of several tens of metres and features predominantly disseminated magmatic sulfides with local net-textured zones. Validation drilling at the New Manitoba deposit by a previous owner (Clifton Star Resources, 2010) returned maximum grades of 1.04% Cu and 0.52% Ni over 42.55 metres in hole CL09-06 (Manitoba Mines Branch Assessment Report 74825, 2010). The similarity in sulfide mineralogy and metal grades suggests good potential for treating material from both the M2 deposit and the New Manitoba deposit at the same concentrator. The Company believes there is good potential to establish a current nickel-copper sulfide mineral resource on the Eagle Claims.

In addition to their demonstrated nickel-copper sulfide potential, the Eagle Claims are believed to be prospective for lithium-enriched pegmatites given that several east-west trending historical spodumene-rich pegmatites are located directly to the east .

Staking Activities

The Company has also acquired, through claim staking, the National Ledin Property. The Property consists of 5 claims covering 1,280 hectares and captures a strong magnetic anomaly that is interpreted to represent the western continuation of the Bird River Sill west of the Gossan Claims.

Upon completion of the transactions with Gossan Resources and First Mining Gold, the Company will become by far the most significant player in the Southeastern Manitoba critical metals exploration and development play.

Dr. Dave Peck, the Company’s Vice President of Exploration and Business Development, has reviewed and approved the content of this news release.

About Grid Metals Corp.

Grid Metals is focused on both lithium and Ni-Cu-PGM in the Bird River area approximately 150 km north east of Winnipeg Manitoba. In addition to the base metal properties discussed herein the Grid is advancing its Donner Lake Lithium project where resource has been completed and the Company is commencing a NI 43-101 mineral resource estimate. Grid’s properties are located in the traditional territory of the Sagkeeng First Nation.

On Behalf of the Board of Grid Metals Corp.

For more information about the Company please see the Company website at www.gridmetalscorp.com or contact:

Robin Dunbar - President, CEO & Director Telephone: 416-955-4773 Email: rd@gridmetalscorp.com

David Black - Investor Relations Email: info@gridmetalscorp.com

We seek safe harbour. This news release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of the Securities Act (Ontario) (together, "forward-looking statements"). Such forward-looking statements include the Company’s closing of the proposed financial transactions, sale of royalty and property interests. the overall economic potential of its properties, the availability of adequate financing and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements expressed or implied by such forward- looking statements to be materially different. Such factors include, among others, risks and uncertainties relating to potential political risk, uncertainty of production and capital costs estimates and the potential for unexpected costs and expenses, physical risks inherent in mining operations, metallurgical risk, currency fluctuations, fluctuations in the price of nickel, cobalt, copper and other metals, completion of economic evaluations, changes in project parameters as plans continue to be refined, the inability or failure to obtain adequate financing on a timely basis, and other risks and uncertainties, including those described in the Company's Management Discussion and Analysis for the most recent financial period and Material Change Reports filed with the Canadian Securities Administrators and available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

This news release does not constitute an offer of securities for sale in the United States. The securities being offered have not been, nor will they be, registered under the United States Securities Act of 1933, as amended, and such securities may not be offered or sold within the United States absent U.S. registration or an applicable exemption from U.S. registration requirements.