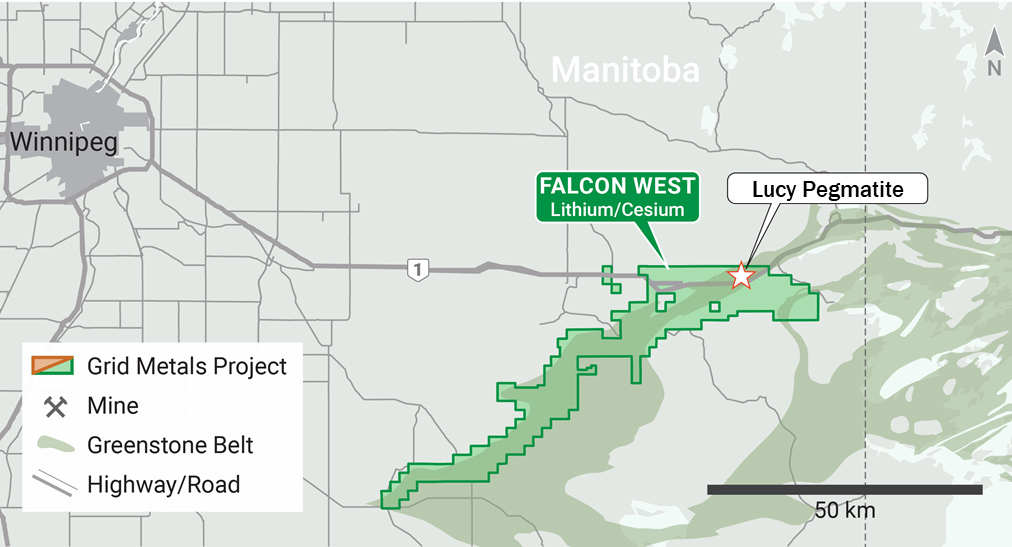

Above: Map of southeastern Manitoba showing the Donner and Falcon West lithium/cesium projects.

Falcon West covers the next prospective greenstone belt south of the world-class Tanco mine which operates North America’s only cesium chemical plant. The project is 100%-owned by Grid.

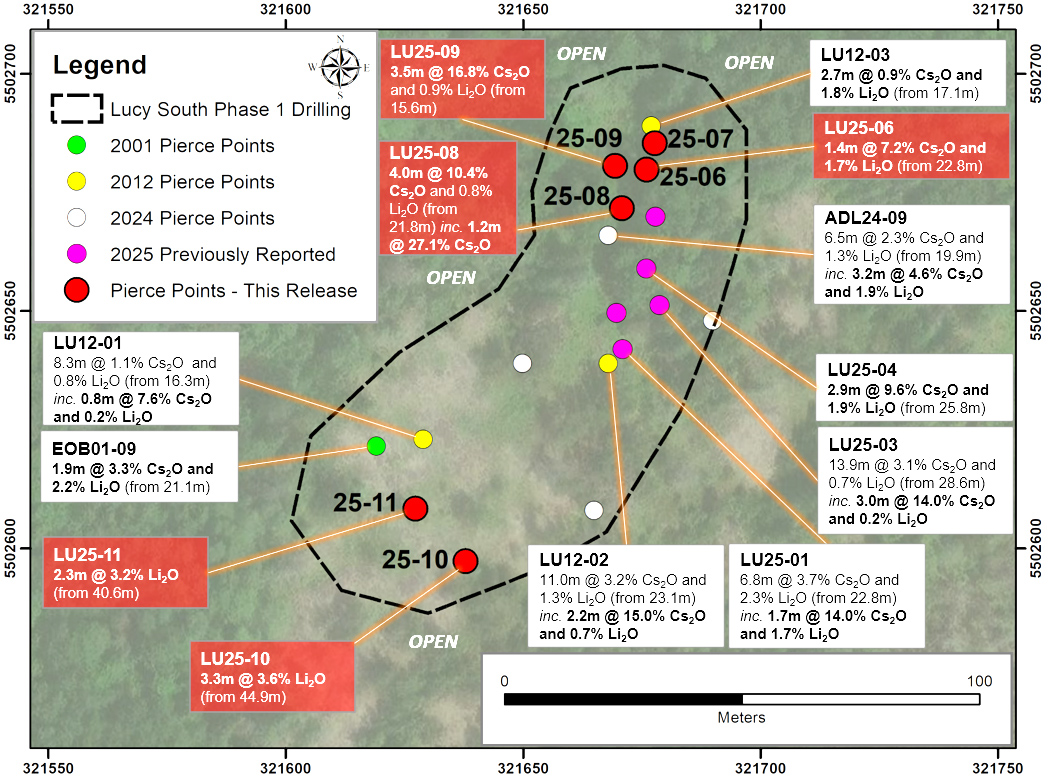

The project boosts high-grade cesium at the Lucy pegmatite. Highlight intercepts include 3.5 m at 16.8% Cs2O (LU25-08) and 2.2 m at 15.0% Cs2O (LU-12-02). In addition, there is a historical non-compliant resource for the Lucy Pegmatite of 226,000 tonnes grading 1.75% Li2O* with the cesium grade undefined (*Grid Metals is not able to verify the accuracy of the estimate and does not consider it a current resource).

Available exploration data indicate that the Lucy pegmatite is a relatively flat-lying and outcropping body that is at least 1 km long and 200 metres wide. Cesium mineralization is concentrated at the upper contact of the Lucy pegmatite that is locally exposed at surface. High-grade cesium intercepts are now defined over a strike length of approximately 100 metres, and the cesium enrichment trend remains open in multiple directions

Above: Falcon West Lithium Property regional map. The property covers the favourable geological contact between the Winnipeg and Wabigoon subprovinces. The Lucy pegmatite has historical drilling with high-grade lithium/cesium.

Above: Plan view with zoom-in on Lucy South Cesium Zone